Recent global events have had a considerable impact on food production, as well as food accessibility worldwide. The Covid 19 pandemic, the Russian Invasion of Ukraine, and a surge in food and energy prices have all accentuated the already existing food crisis in Africa. For instance, about a fifth of the continent suffered from hunger in 2022. These events have added pressure on local food systems, which were already dealing with multiyear droughts in the Horn and East Africa; a locust swarm; the internal conflict in Ethiopia; flood, drought, conflict, and the economic effects of COVID-19 in West Africa to name a few.

Nonetheless, despite this grim picture of the continent’s agricultural sector, the later still presents enormous potential. It is important to note that there are still a considerable number of structural barriers within the sector, but with the right investments, Africa stands to build one of the most resilient agricultural ecosystems in the world.

TG Africa was commissioned to conduct an appraisal of the Africa Agriculture and Trade Investment Fund (AATIF) investment of EUR 17.5 million in NSIA Bank in Cote d’Ivoire. AATIF is an innovative public-private partnership dedicated to the enhancement of agricultural value chains in Africa, with the ultimate objective to improve food security and ensure business growth for African farmers. AATIF investments target primary production, as well as agricultural businesses along the entire agricultural value chain which are financed directly or indirectly. Direct investments focus, among others, on processing companies and farming operations. On the other hand, indirect investments target local financial institutions, which through loans can lend to smallholder farmers, as well small and medium enterprises. The fund is supported by different organizations: Common Fund for Commodities (CFC) as Technical Assistance (TA) Facility Manager, DWS Group (DWS) as Investment Advisor, International Labour Organization (ILO) and UN Environment (UNEP) as Sustainability Advisor. AATIF expects that Financial Institutions (hereafter “FIs”) can expand their activities in the agricultural sector, and also that the overall conditions for social and environmental management at FIs are improved.

The main objective of this appraisal was to evaluate how the investment contributed to changes (institutional capacity, products and portfolio, ESG / CSR impact) in the Financial Institutions (FIs), and how in cascade these changes impacted the agricultural value chain, focussing on intermediary beneficiaries (investees) and end beneficiaries (farmers and farmers’ associations).

A second objective, which was also an intermediary step for achieving the first objective, was to produce – as a core methodological base – both:

- A specific framework for the Financial Institutions (FIs) that might be used for other evaluations of AATIF’s investments. Indeed, the current methodological framework developed by AATIF for rapid appraisals focusses on end and intermediary beneficiaries, it is not specific to FIs.

- And a macro analysis of the most relevant agricultural sector or value chain for the FI, which will allow to identify the right stakeholders to approach in a short period of time and with limited resource.

BROADER CONTEXT

What is ESG and ESG investing

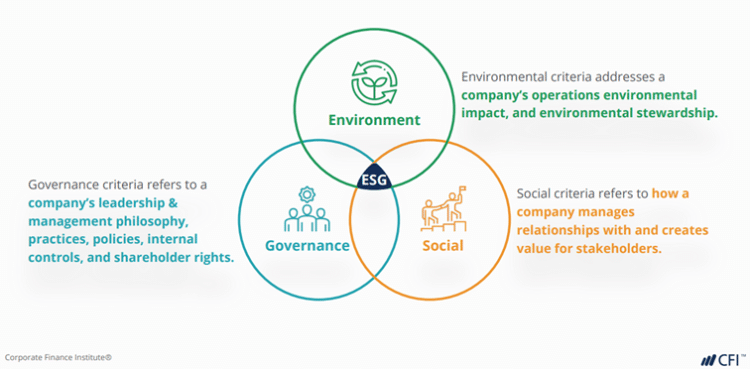

ESG stands for Environmental, Social, and Governance. It refers to the three key factors when measuring the sustainability and ethical impact of an investment in a business or an organisation. According to the Corporate Finance Institute (CFI), ESG is used as a framework to assess how an organisation manages risks and opportunities that shifting market & non-market conditions create. These shifts include changes to environmental, social, and economic systems that impact the entire landscape in which the organisation operates.

ESG is less about the values and more about the ability to create & sustain long-term value in a rapidly changing world, and managing the risks & opportunities associated with these changes.

There is no universal categorisation for ESG issues, and some can be defined in different ways depending on the industry, company characteristics, and the business model.

ESG is often used interchangeably with corporate social responsibility (CSR) or corporate sustainability, however ESG encompasses much more. Many issues fall within the ESG categories, and these can be classified in a variety of ways depending on the rating body, perceived material relevance, and the disclosure framework used for reporting. Common ESG factors include:

- Environmental: climate change (physical risks, transition risks, human risks), natural resources scarcity, pollution and waste;

- Social: community and customers engagement, responsible sourcing, human capital management (employees), human rights, labor management; diversity, equity, and Inclusion;

- Governance: board quality, diversity, and effectiveness; reporting, transparency, business ethics; supply chain management.

Why is it important?

ESG practices are often driven by internal (employees, owners) and external (customers, suppliers, investors, etc.) stakeholders’ expectations and pressure. Adopting ESG practices can have a significant positive impact on fundamental business issues relevant to the long-term success of any company across industries, such as:

- Corporate reputation: ESG can enhance a company’s license to operate making it easier to accomplish business objectives and respond to crisis scenarios with key stakeholder groups.

- Risk reduction: ESG helps identify immediate & long-term risks (e.g. material and labor availability, evolving regulations) depending on the industry and business model.

- Culture and intrinsic value: ESG maturity is an indicator of a company’s commitment to building a high performing, purpose-driven workforce and inclusive culture, that can improve investment outcomes.

MAIN IMPACT

To perform the appraisal, the following principles were followed:

- A theory-based assessment relying on a contribution analysis.

- Prioritising learning and a collaborative approach.

- Capitalising on existing data & evidence and combining qualitative and quantitative investigations.

We proposed a framework to assess Fis that might be used for other evaluations of AATIF’s investments, including an evaluation matrix, an impact assessment method, and the tools to be used.

The framework aims to assess effects for FIs:

- On the portfolio

- On the products and clients

- On the capacities

- to offer adequate labor and working conditions, social and environmental management policies, S&E standards, policies guideline and procedures, roles & responsibilities, capacity of staff, monitoring and reporting.

- to acquire and maintain a robust and appropriate digital and data analytics infrastructure for distribution of products and services, credit scoring, ESG management, client data.

- to mitigate its environmental impact (energy consumption, water consumption, environmental performance).

- to gather data related to Principal Adverse Impacts: The Principal Adverse Impacts (PAI) regime is a part of the EU’s Sustainable Finance Disclosure Regulation (SFDR). It requires relevant firms to provide extensive disclosures on various ESG related matters, including greenhouse gas emissions and other indicators, in a template format.

We also wrote an impact brief based on the key findings to be published on AATIF’s website. The findings include:

- At Financial Institution-Level: Agricultural portfolio performance, Agricultural portfolio strategy, Social and Environmental Management System, Environment and employment.

- At Direct beneficiaries’ level: Contribution of loans provided by NSIA Banque Cote d’Ivoire, Employment, Environmental and Social impact.

- At Indirect beneficiaries’ level: Impact on indirect beneficiaries, Environmental and social impact.

Overall, we strongly recommended the adoption of ESG practices at NSIA Banque Cote d’Ivoire as these offer some benefits for such FIs:

- Alignment with international agendas and enhanced credibility: it shows the commitment to addressing climate change and promoting socially and environmentally sustainable practices. It enhances its credibility both domestically and internationally, attracting investors, partners, and clients who prioritise climate-responsible initiatives.

- Project scaling: substantial funding can enable FIs to scale up. This is crucial in Africa, particularly vulnerable to climate change impacts that requires large-scale interventions.

- Network and collaboration: ESG accreditations opens doors to a network of international partners, organisations, and experts working on climate-related initiatives. Collaborations can lead to knowledge sharing, joint projects, and increased impact.

- Showcasing leadership: as a national development bank, seeking ESG accreditation can demonstrate leadership in advancing ESG practices. It sends a strong signal to other financial institutions, public authorities, and national stakeholders about the importance of integrating ESG considerations into financial strategies.